Welcome to your go-to solution for credit card processing that's straightforward and transparent. We believe in keeping it real, just like you do. With our service, there are no hidden fees, no unexpected charges—just seamless, hassle-free transactions that let you focus on what you do best: growing your business. Let us handle the payments, so you can crush your goals and scale to new heights.

Ready to take control? Let’s do this!

Dual Pricing

Dual Pricing is not a new program; many businesses, especially gas stations around the country, have been offering cash and regular prices for over a decade. Similar to Cash Discount 2.0, when a business offers Dual Pricing, they maintain 100% of the cash price for every item they sell. It is legal in all 50 states and not just for gas stations. With the correct technology solution, any business can correctly use a dual pricing program.

Dual Pricing is a transfer-pricing approach that separates customers based on their ability to pay. It uses two separate transfer pricing methods to price each inter-division transaction.

Unlock the Power of Dual Pricing

Discover how dual pricing can transform your business:

Boost Your Revenue: Tap into the potential of high-income customers by offering premium products or services. Dual pricing allows you to cater to a larger, more diverse market, driving increased sales and profits.

Master Sales Control: Regulate your sales effortlessly. Dual pricing sets distinct price points, naturally managing demand and optimizing your inventory.

Thrive Through Market Changes: Stay resilient in fluctuating markets. A strategic dual pricing system keeps your business strong, even when demand shifts, ensuring stability and growth.

Achieve Strategic Success: Invest time in perfecting your dual pricing approach. The rewards of a tailored pricing strategy will elevate your business to new heights, fostering long-term success and customer satisfaction.

We make payments simple, secure, and reliable.

Simply and securely integrate, accept and manage payments.

Frequent Asked Questions

What is the Dual Pricing Program?

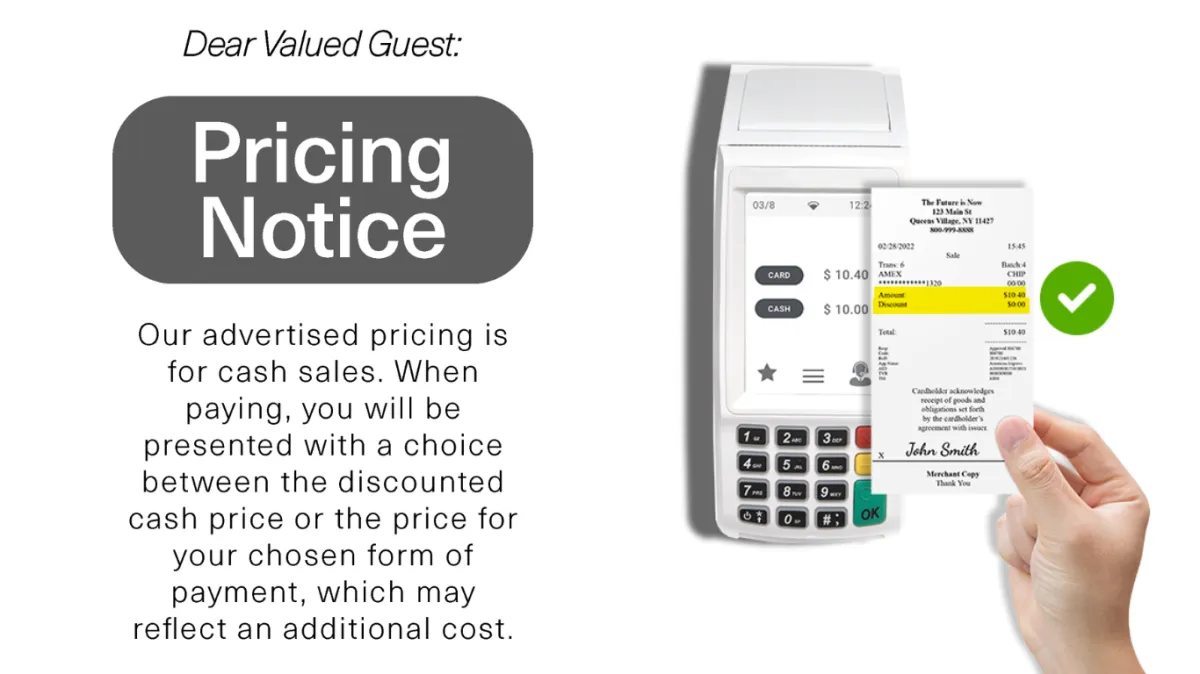

Dual pricing is a powerful strategy that allows you to present both cash and card prices to your customers, giving them the freedom to choose how they want to pay. Here’s how it works:

Two Prices, One Choice: With dual pricing, you display two prices for each product or service—one for cash payments and one for card payments. This transparent approach ensures your customers know exactly what they’ll pay, no matter how they choose to pay. It’s all about empowering your customers with options while keeping your business costs in check.

Cost Management Made Simple: The key benefit of dual pricing is that it allows you to manage credit card processing fees more effectively. When customers opt to pay by card, the slightly higher price reflects the cost of processing that payment, so you’re not absorbing those fees. This means you can maintain your profit margins without compromising on customer service.

Seamless Implementation: Implementing dual pricing is straightforward with our support. We provide everything you need, from pricing display through our terminals or gateway integration to compliant signage that clearly communicates the dual pricing structure. Plus, we handle all the necessary notifications to card brands, making the process smooth and hassle-free for you.

Customer-Centric Approach: Dual pricing isn’t just about managing costs—it’s about enhancing the customer experience. By offering clear and transparent pricing, you build trust and satisfaction, helping to strengthen customer loyalty and encourage repeat business.

In essence, dual pricing is about giving your customers the power of choice while ensuring your business runs efficiently and profitably. It’s a win-win that aligns your needs with your customers’ expectations.

Ready to explore how dual pricing can benefit your business? We’re here to help you every step of the way!

Is Dual Pricing right for my business?

When it comes to choosing the best pricing strategy for your business, dual pricing can be a powerful tool. But is it the right fit for you? Let’s explore why it might be:

Transparency and Choice: Dual pricing empowers your customers by giving them the choice between paying with cash or card, with clear pricing for both options. This transparency can build trust and enhance customer satisfaction, as they feel in control of how they spend their money.

Cost Management: If you’re looking to manage or even offset the costs associated with credit card processing fees, dual pricing can be an excellent solution. By displaying both prices, you ensure that the cost of card processing is covered, allowing you to maintain healthy profit margins without sacrificing customer service.

Simplicity and Compliance: With our support, implementing dual pricing is straightforward and compliant with industry regulations. We provide everything you need—from pricing display through our terminals or gateway integration to a starter kit for signage. Plus, we take care of the details, like notifying card brands, so you can focus on running your business.

Customer Experience: Businesses that prioritize customer experience often find dual pricing to be a great fit. It keeps pricing transparent and ensures customers have all the information they need to make the payment choice that’s right for them.

In short, if your goals include enhancing transparency, managing costs effectively, and providing a seamless customer experience, dual pricing could be the right move for your business. We’re here to help you evaluate how this strategy can work for you, and we’re ready to support you every step of the way.

Let’s discuss how dual pricing can fit into your business model and take your operations to the next level!

What is required to enroll in our Dual Pricing Program?

Enrolling in our Dual Pricing Program is simpler than ever! Here’s what you’ll need:Ability to Display Prices: You’ll need to display both the cash and card prices for each inventory item, menu item, or invoice. The good news is, we provide the displayed pricing through our terminals or gateway integration, making it easy for you to offer clear and transparent pricing to your customers.Compliant Signage: To ensure everything is clear and compliant, we provide a starter kit that includes all the necessary signage for your business. This signage will clearly communicate the dual pricing structure to your customers, keeping everything straightforward and easy to understand. Adding dual pricing as a money-saving solution is straightforward with our fully featured payment gateway. Plus, we handle all the necessary communications with the card brands on your behalf, saving you both time and money. We’re here to support you every step of the way, making the transition to dual pricing as smooth and beneficial as possible!

How Do I Implement Dual Pricing in My Existing System?

Implementing dual pricing in your existing system is a straightforward process, and we’re here to make it as seamless as possible. Here’s how you can get started:

Assessment and Integration: The first step is to assess your current setup—whether it’s a POS system, an online store, or invoicing software. Our team will work with you to ensure that your existing system is compatible with dual pricing. The good news is, if you’re using QuickBooks or similar integrations, there’s no need for an upgrade. Our system seamlessly integrates with these platforms.

Free Terminal Device: To help you get started, we offer one free terminal device—the Q2—per merchant ID (MID). This terminal is fully equipped to handle dual pricing, ensuring a smooth transition without any additional cost to you.

Setup and Configuration: Once compatibility is confirmed, we’ll guide you through the setup process. This involves configuring your system to display both cash and card prices for each item or service you offer. With our fully featured payment gateway and the Q2 terminal, configuring dual pricing is quick and efficient.

Signage and Communication: To ensure compliance and transparency, we provide a starter kit that includes all the necessary signage. This signage will clearly communicate the dual pricing structure to your customers. We’ll help you place these signs in key areas so that your customers are informed before they make a payment decision.

Training and Support: We understand that implementing a new pricing structure might require some adjustments. That’s why we offer comprehensive training and support to ensure you and your team are comfortable with the new system. We’re here to answer any questions and provide ongoing support as needed.

Launch and Monitor: After everything is set up, you’re ready to go live with dual pricing! We recommend monitoring the initial phase to gather feedback from your customers and staff. This allows you to make any necessary tweaks to ensure the system is working smoothly and effectively.

By following these steps, you can implement dual pricing in your existing system with minimal disruption. With our free Q2 terminal and seamless QuickBooks integration, the transition is easier than ever, so you can start enjoying the benefits of dual pricing right away.

What Will Dual Pricing Cost Me?

Dual pricing is a straightforward way to present both cash and card prices to your customers, letting them choose how they want to pay. As a merchant, the cost to use dual pricing is $49.99 per month. For each transaction, there’s a fee of 3.00% plus $0.10, which is passed on to the customer if they choose to pay with a credit or debit card. This means that when a customer decides to pay with a card, they will see a slightly higher price that covers the card processing fees. If they choose to pay with cash, they’ll pay the lower cash price. This setup ensures that you, as the merchant, are not absorbing the cost of card processing fees, making it easier to manage your expenses while offering clear and transparent pricing to your customers. If you’re new to dual pricing, don’t worry—it’s easy to implement, and we’re here to guide you through the process!

How Does Dual Pricing Affect Customer Satisfaction?

Dual pricing can actually enhance customer satisfaction by providing transparency and empowering customers with choice. Here’s how:

Clear Communication: With dual pricing, your customers see exactly what they’ll pay depending on whether they choose to pay with cash or a card. This upfront transparency builds trust, as customers appreciate knowing the exact cost before they make a decision. When customers feel informed, they’re more likely to have a positive experience.

Empowerment Through Choice: Dual pricing gives your customers the freedom to choose the payment method that best suits their needs. Whether they want to save a little by paying with cash or prefer the convenience of using a card, the choice is theirs. This sense of control can increase customer satisfaction, as they feel empowered to make the decision that works best for them.

No Hidden Fees: One of the frustrations customers often have been encountering unexpected fees at checkout. Dual pricing eliminates this concern by clearly showing both the cash and card prices upfront. This transparency reduces the likelihood of customers feeling surprised or misled, which can lead to higher satisfaction and loyalty.

Positive Perception: By offering dual pricing, you’re demonstrating that your business is committed to fairness and transparency. Customers appreciate businesses that are honest and straightforward about pricing, which can enhance their overall perception of your brand.

In summary, dual pricing, when implemented and communicated effectively, can lead to higher customer satisfaction. It fosters trust, provides clear choices, and eliminates the frustration of hidden fees, all of which contribute to a more positive customer experience.

How Does Dual Pricing Compare to Traditional Pricing Models?

When choosing a pricing strategy for your business, it’s important to understand how dual pricing stacks up against traditional pricing models. Here’s a direct comparison to help you see the unique benefits of dual pricing:

Transparency and Customer Trust: Traditional Pricing: With traditional pricing, customers see one price, but they might not be aware of the hidden costs associated with credit card processing fees that the business is absorbing. This can sometimes lead to confusion or mistrust if customers feel that prices are higher than expected. Dual Pricing: Dual pricing offers complete transparency by clearly displaying both the cash price and the card price. Customers know upfront what they’ll pay depending on their chosen payment method, which builds trust and enhances their overall experience.

Cost Management: Traditional Pricing: In a traditional pricing model, the merchant absorbs the cost of credit card processing fees. These fees can add up quickly, eating into profit margins and forcing businesses to increase prices across the board to compensate. Dual Pricing: With dual pricing, the cost of credit card processing is passed on to the customers who choose to pay with a card. This allows you to maintain your profit margins without having to raise prices for all customers, ensuring that your business remains competitive and profitable.

Flexibility for Customers: Traditional Pricing: Customers have limited awareness or options regarding payment methods under traditional pricing. They pay the same price regardless of how they choose to pay, with no insight into the associated costs.

Dual Pricing: Dual pricing empowers customers by giving them the choice between paying with cash or card, with the costs clearly outlined for each option. This flexibility can lead to higher customer satisfaction, as they feel more in control of their spending.

Business Profitability: Traditional Pricing: Absorbing card processing fees can make it challenging to keep your prices competitive while still maintaining healthy profit margins. This can be particularly tough for small businesses or those with thin margins. Dual Pricing: By passing on the processing fees to card-paying customers, dual pricing helps you protect your profit margins. This allows you to keep your prices competitive for cash-paying customers, while still covering the costs associated with card transactions.

In summary, dual pricing provides a more transparent, flexible, and cost-effective solution compared to traditional pricing models. It allows you to manage costs more effectively, maintain profitability, and offer your customers clear choices—ultimately enhancing both your business operations and customer satisfaction.

You Drive the Sales.

We'll chase the payments.

Our expert team ensures you get paid quickly and efficiently, so you can focus on expanding your business and achieving your goals.

Streamline Payments with Powerful Solutions

Save Money

Focus On Growth

Simplify Transactions with Confidence

INCREASE YOUR SALES, REDUCE YOUR COSTS

We tailor your solutions to meet both your unique needs and goals

In today's complex business landscape, every facet of your payment processing directly influences your bottom line. At GlobalPAY, our approach begins with understanding; we take the time to listen and really comprehend the intricacies of your business. What we've discovered is that, more often than not, many merchants are overpaying —

Getting to know your business inside and out

We are dedicated to grasping your business objectives, growth plans, and payment processing needs to provide tailored solutions. Understanding your current position and future direction is vital for controlling operational expenses effectively. Trust us to guide you towards optimal efficiency and profitability.

Let's conduct a cost analysis to uncover potential savings

Imagine the potential of recovered expenses for your organization. Unlock new initiatives and possibilities with increased cash flow. Let us empower you. Small adjustments can notably cut costs. As you grow, these savings amplify. By trimming operating expenses, you could reclaim significant revenue, boosting profit margins.

Let’s Talk Savings!

© Copyright 2024. GlobalPay, LLC. All rights reserved.